Article

The Insolvency and Bankruptcy Code – Not a Brittle Framework

Sourav Sardar examines the assertion of Dr. Urjit Patel as to whether the Insolvency and Bankruptcy Code has been really weakened due to the interventions of the Government or not.

- SC in Swiss Ribbons Vs. Union of India (25th January 2019)

-

Sourav Sardar

Sourav Sardar

Introduction

The Insolvency and Bankruptcy Code, 2016 (Code) is a major reform that was introduced by the Government of India in the year 2016. It completes the basket of economic freedoms by giving the freedom to exit businesses and its success can be gauged from the recent improvement in India’s ranking in the World Bank Ease of Doing Business Rankings from 77 to 63.The jump in India’s ranking from 136 to 52 on the ‘resolving insolvency’ parameter in the last three years has been the major contributor. But in the last few weeks, the Government has come under criticism from none other than a distinguished figure like Dr. Urjit Patel, Former Governor, Reserve Bank of India (RBI) and presently Chairman, National Institute of Public Finance and Policy, New Delhi. Dr. Patel alleges that the Government had gone on a soft pedal1 while driving the Code, thereby leading to a situation where the gains achieved on the behavioral front of “debtor be aware” by a tough implementation of the Codewas probably lost. This assertion of Dr. Patel needs to be examined further as to whether the Code has been really weakened due to the interventions of the Government or not?

Amendment to the Banking Regulation Act and RBI Circular

The provisions relating to the corporate insolvency resolution process (CIRP) in the Code came into force on 1st December, 2016 and till 31st March 2020, 3774 companies are undergoing CIRP or have already undergone CIRP. Out of the total admitted cases of 3774, 49.65% of the cases have been initiated by operational creditors (goods and service providers) while 43.61% have been initiated by financial creditors (banks and financial institutions) and the rest by the corporate debtors (CD) themselves. Therefore, it must be kept in mind that most of the cases i.e. almost half the cases have been initiated by the goods and service providers not by the banks and financial institutions.

For the purpose of resolution of stressed assets by timely identification and recognition of stressed accounts, the Central Government promulgated the Banking Regulation (Amendment) Ordinance, 2017 (w.e.f. 4th May 2017) (Ordinance) which inserted sections 35AA and 35AB into the Banking Regulation Act, 1949 (BR Act). These provisions firstly, empowered the Central Government to authorize theRBI to issue directions to any banking company to initiate insolvencyresolution process in case of default and secondly, it allowed the RBI to issue directions to banking companies for resolution of stressed assets. Together, it was felt, that these provisions will aid the resolution of stressed assets in the banking system which had reached unacceptably high levels as per the Ordinance. This Ordinance was later converted into an Act by the Banking Regulation (Amendment) Act, 2017.

The RBI in furtherance of its powers under the amended BR Act came out with the 12th February, 2018 Circular (February Circular) which provided for a revised framework for resolution of stressed assets. It may be noted that this circular was preceded by the identification of 12 accounts by the RBI’s Internal Advisory Committee [IAC]. These 12 accounts constituted approximately 25% of the NPAs in the system and CIRPs were initiated against these 12 accounts vide RBI’s direction dated 15th June 2017.

The February Circular provided for resolution of a stressed asset outside the Code by a restructuring plan termed as the resolution plan (this resolution plan is not the same as that provided for under the Code). This restructuring plan must be agreed to by 100% of the lenders. This circularwas applicable in case of resolution of debts with aggregate exposure of INR 2000 Crores or more. In case ofdefault on or before 1st March 2018 (cut-off date) which persists for 180 days from the cut-off date or in case of default after the cut-off date then, 180 days from the date of default, the lenders shall within 15 days of the expiry of the 180 days period, initiate CIRP either singly or jointly with other lenders. This means that if the restructuring plan is not implemented within 195 days (180 days + 15 days), then the lenders must compulsorily initiate CIRP against the debtor.

Standing Committee Report and Legal Challenge

This one-size-fits-all measure, posed practical difficulties in the context of certain sectors like the power sector which was reeling under the double whammy of cancellation of coal blocks by an order of the Supreme Court and non-payment of dues by DISCOMs. The 40th Report of the Parliamentary Standing Committee on the impact of the February Circular on NPAs in the power sector, observed that lenders like the Rural Electrification Corporation and the SBI submitted before the Standing Committee that the 180 days’ time period given in the February Circular for implementation of the restructuring plan, is impossible and arriving at a 100% consensus of lenders is very difficult. After considering all opinions and arguments,the Standing Committee recommended that the RBI should not adopt sector agnostic stressed asset resolution framework like the February Circular and should come out with sector specific resolution frameworks.The report also stated that the revised framework ignores the ground realities.

Thereafter, the constitutionality of sections 35AA and 35AB of the BR Act under which the February Circular was enacted, came under question before the Supreme Court of India in the matter of Dharani Sugars Vs. Union of India [2019 SCC OnLine SC 460]. The Supreme Court (SC) in its wisdom, upheld the constitutional validity of sections 35AA and 35AB of the BR Act but held that the RBI can only give directions in respect of specific defaults and that too on authorization from the Central Government. Therefore, the circular was held to be ultra vires and thus, has no effect in law. Further the SC also ruled that all proceedings initiated only because of the operation of the circular are non-est.

Revised RBI Circular

The RBI issued a revised circular dated 7th June 2019 (June Circular)which had no reference to initiation of CIRP against the defaulters but provided for additional provisioning of accounts which have defaulted depending on the number of days of default. The circular also stated that it would not prejudice any specific directions from the RBI to the lenders for initiation of CIRP against defaulting companies. Therefore, under the new framework, the decision to initiate CIRP is largely left to the decision of the creditors, subject to the specific directions of the RBI. This is in consonance with the observations of the SC in the Dharani Sugars matter wherein the SC observed that for exercise of the power of the Central Government under the amended BR Act required due deliberation and care. It was felt that this power cannot be exercised in a one-size-fits-all manner.

TheJune Circular strikes a balance by providing flexibility to the lenders to negotiate with the defaulters, to take a considered decision as to whether the matter needs to be referred to the NCLTs and protects the balance sheets of lenders by providing for additional provisioning. Further the RBI may also give specific directions to the lenders to initiate CIRP against CDs, if there is an imminent need for it.Even though FebruaryCircular was struck down, the use of the Code is not impacted. The operational creditors have been major users of the Code in terms of initiation of CIRP. Once a CIRP has commenced on an application by any creditor, every creditor submits its claim and the process goes on and ends either with resolution or liquidation or withdrawal by settlement.

Nudging, Data and Number of Cases Filed

Dr. Patel argues that without the February Circular which forces lenders to take the NCLT route to resolution of stressed assets, the Code probably becomes brittle2 and delays the recognition of stressed accounts by the banks and therefore aggravates the NPA problem. Nothing could be further from the truth as the banks are not the only creditors in the ecosystem. There are operational creditors who constitute the major chunk of creditors in terms of numbers and the data establishes that they are the ones who have initiated most of the CIRPs.

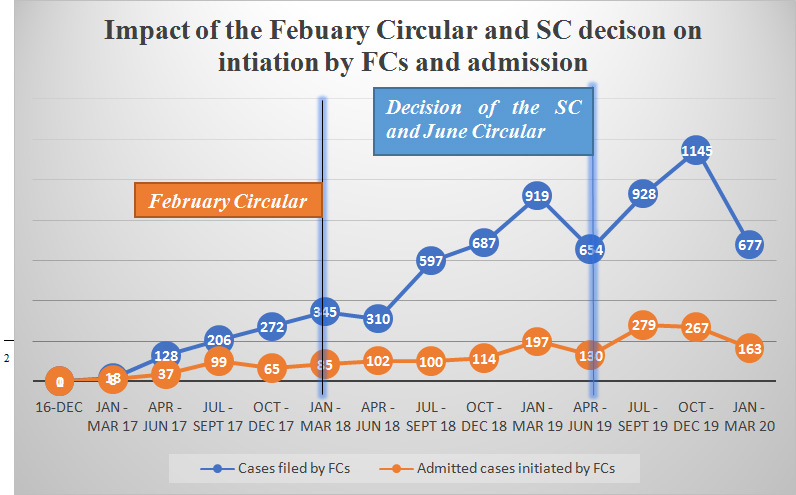

In the graph shown above3, the blue line tracks the number of cases filed by financial creditors under the Code quarter-wise and the orange line tracks the number of companies admitted by the NCLTs quarter-wise in which the case was initiated by financial creditors. The relevant dates of the February Circular and the decision of the SC scrapping the February Circular have also been indicated in the graph. It can be seen from the graph that April-June, 2019 quarter there is a dip in the number of filed case over the previous quarter as the decision of the SC was given on 2nd April, 2019 but thereafter for the next two quarters the number of filed cases have consistently risen with a dip in the January-March, 2020 quarter probably due to the declaration of lockdown due to COVID-19. For the same period the number of admitted cases have also risen with a dip in the January-March, 2020 quarter due to the lockdown.

Looking at the number of cases filed prior to the February Circular, it seems that there was a steady rise in cases filed but after the February Circular, there was an overall exponential rise in the number of cases being filed. This Circular acted as a nudge to the banks to make appropriate use of the NCLTs. With the progress of time, as the teething troubles and uncertainties around the Code were corrected by amendments and judicial decisions, creditors became more confident in using the Code as a tool for resolution of stressed assets and therefore the consistent rise is seen in the number of cases files by FCs even after the February Circular was struck down by the Supreme Court. It can be said that the number of cases being filed by FCs became agnostic to the February Circular once, the momentum of filing cases built up which is seen by the rise in number of cases filed even after the Circular was struck down by the SC.

It is clear from the data that no creditor alone has the authority to determine who is a defaulter and who is not as is made out by Dr. Patel, who believes that the judgment of the Supreme Court striking down the February Circular effectively gives a veto to the Government to decide who is a defaulter.4 The right to initiate CIRPhas been given to many creditors and thus the power is diffused and not concentrated in any single hand as is made out by Dr. Patel.

4. Supra note 1, at 74-75.

Steps taken by the Government to Strengthen the Code

Contrary to the views of Dr. Patel, the Government has taken several steps to strengthen the Code. A standing committee of experts from the Government and private sector called the Insolvency Law Committee (ILC) which is headed by the Secretary, Ministry of Corporate Affairswas formed.The ILC continuously reviews the working of the Code and recommends amendments and changes needed in the law depending on the market trends and evolving jurisprudence in the insolvency space. The major amendments made to strengthen the Code are provided in the table below:

| Sl. No. | Amendment Act/Rules | Important Changes | Remarks |

|---|---|---|---|

| 1. | Insolvency and Bankruptcy Code (Amendment) Act, 2017 (w.e.f 23rd November, 2017) |

|

Section 29A is a major reform, which has contributed to the behavioral change in the market as the promoters now have a fear that they may lose their companies if they do not pay their debts. |

| 2. |

Insolvency and Bankruptcy Code (Second Amendment) Act, 2018 (w.e.f 6th June 2018) |

|

|

| 3. |

Insolvency and Bankruptcy Code (Amendment) Act, 2019 (w.e.f 16th August 2019) |

|

|

| 4. |

Insolvency and Bankruptcy Code (Amendment) Act, 2020 (w.e.f 28th December 2019) |

|

|

In addition to the amendments made, Rules made under section 227 of the Code have been enforced which extends the application of the Code to financial firms which are not covered under the general scheme of the Code. This was done considering the stress in the housing sector and at present the Dewan Housing Finance Ltd is undergoing CIRP under this process. Further Part III of the Code has been enforced in respect of personal guarantors to corporate debtors. Over the three years of existence of the Code, it can be said with certainty that the Code has not remained stagnant, it is a living document and has evolved as per the requirements of the market and the Government must get due credit for it.

Further to ensure transparency, an Information Utility (IU) is operational which provides authenticated information to facilitate creditors to establish default and substantiate claims. This record of default eases the process and ensures that there is timely admission of cases by the AA. All FCs must share their financial information with the IU as per section 215 of the Code. In furtherance of this provision, the RBI had issued a circular dated 4th January 2018 which directs all FCs to share their financial information with the IU.

Judicial Decisions which Strengthen the Code

In addition to the efforts of the Government, the judiciary has delivered landmark judgments which have strengthened the Code and ensured its smooth implementation. Some of the landmark judgments are discussed below:

Overriding effect of the Code

Section 238 of the Code, gives an overriding effect to the Code, this means that any law inconsistent with the Code, to the extent of such inconsistency shall be not be applicable in a matter where the provisions of the Code are applicable. This provision resolves ambiguity in the implementation of the Code and smoothens the implementation process for the Code. This issue has been litigated before the court multiple times such as in Pr. Commissioner of Income Tax Vs. Monnet Ispat and Energy Ltd. [Petition for Special Leave to Appeal (C) No(s) 6483/2018 (SC)] it was held that the Code shall override the Income Tax Act, 1961 and in Pioneer Urban Land and Infrastructure Limited & Anr. Vs. Union of India & Ors. [WP(C) No. 43 of 2019 (SC)] it was held that Real Estate (Regulation and Development) Act, 2016 (RERA)and the Code should co-exist but in case of clash, RERA must give way to the Code as it is a later enactment.

Primacy to Commercial Wisdom of the Creditors

The role of the Adjudicating Authority (AA) in CIRP is limited and extends to ensuring fairness in the process. Even the power of the AA is limited while approving the resolution plan under section 31 of the Code. The SC in Committee of Creditors of Essar Steel India Limited Through Authorised Signatory Vs. Satish Kumar Gupta [CA No. 8766-67 of 2019] had held that judicial review by the AA must be with in the four corners of section 30(2) of the Code, which provides for the essentials of the resolution plan. CIRP being a market driven and collective process, the AA cannot interfere in the commercial decisions of the Committee of Creditors (CoC). The SC had ruled so in the matter of K. Sashidhar Vs. Indian Overseas Bank & Ors. [CA. No. 10673 of 2018 andothers].

Protecting the timelines

The SC in Innoventive Industries Ltd. Vs. ICICI Bank & Anr. [CA Nos. 8337-8338 of 2017] had held that time is of the essence in the implementation of the Code. Further the SC in Arcelormittal India Private Limited Vs. Satish Kumar Gupta & Ors. [CA Nos. 9402-9405 of 2018] had held that the model timeline provided under the IBBI (CIRP) Regulations, 2016 are mandatory and must be adhered to in the process. This ensures that valuable time is not lost in process which might potentially affect the valuations of the CD.

Success of the Code

The first order objective of the Code is rescuing life of a company in distress.5 Till 31st March, 2020, 221 companies have been rescued through resolution plans.6 Out of these 221 resolved companies, the creditors realized 183% of the liquidation value of these companies.7 Any other option of recovery or liquidation would have recovered at best 100 minus the cost of recovery/liquidation, while the creditors realised 183 under the Code, after rescuing the companies. This excess recovery of 83 is a bonus from the Code.8 Though recovery is incidental under the Code, the financial creditors, as compared to their claims, recovered 43%.9 Further applications have been filed by insolvency professionals in respect of avoidance transactions, to recover assets which has been illegally transferred by the directors/promotors. Also, prosecutions have been initiated against errant promoters and resolution applicants who have not honoured the terms of their resolution plan before special courts.

6. IBBI Newsletter (January-March, 2020).

7. Id.

8. M.S. Sahoo, “Achievement of the Insolvency Code is that debtors now resolve defaults in early stages” [The Indian Express, available at https://indianexpress.com/article/opinion/columns/the-real-reform-remove-term-insolvency-and-bankruptcy-code-insolvency-and-bankruptcy-code-6313291/].

9. Supra note 6.

This shows that the process has not been weakened at any stage and the Government has proactively plugged loopholes in the law to make the process full proof.It is beyond doubt that the Code is a success which has been strengthened from time to time by the Government. Future initiatives which are in the pipeline such as special framework for MSMEs, pre-pack, Fresh Start Process and Cross Border Insolvency will further strengthen the Code.

- FIR Copy of Mahatma Gandhi assasination case

- Licito Concurso'20

- Rules for Licito Concurso '20- A National Legislative Drafting Competition

- Registration Form for Licito Concurso-20

- www.apexcourtweekly.substack.com

- www.lawupdater.com/wp/

- XIIIth K.K. Luthra Memorial Moot Court Competition 2017

- President of India Presented with the First Copy of the Book Statement of Indian Law Published by Thomson Reuters